Calling All First Time Buyers: Your Window of Opportunity is Here

- Michelle Schwinghammer

- Sep 7, 2022

- 2 min read

Updated: Nov 3, 2022

CAUTION: Blink and you might miss it ...

If you want to buy a home in the Denver metro area, at an appraised price, using a commercial, FHA or VA loan, enjoy a choice of properties to consider, take advantage of down-payment assistance programs, and confidently negotiate what were normal and reasonable (pre-pandemic) seller concessions with regard to inspection, appraisal, financing and seller credits — 4Q22 may be prime time to make your move.

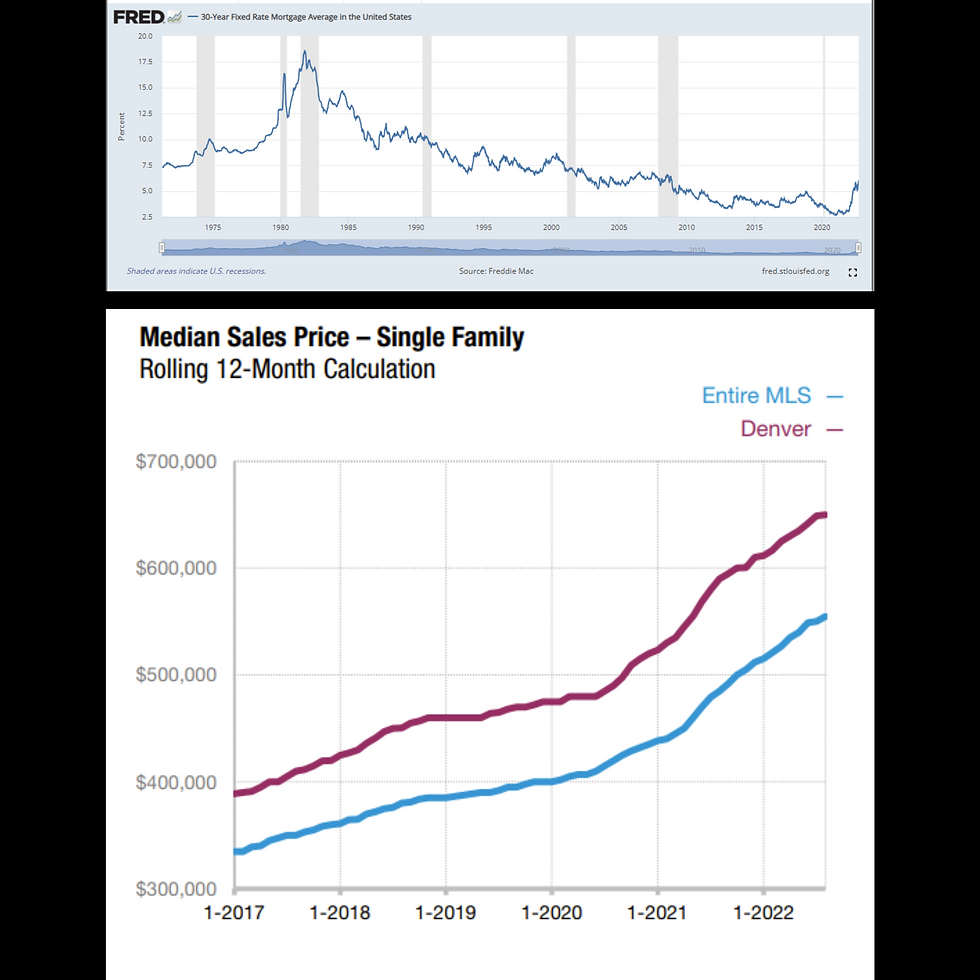

HERE'S WHY: Without doubt, the Fed's aggressive, back-to-back interest rates hikes this summer stunned the market, and came at the exact moment post-pandemic waves finally began to stabilize and normal real estate seasonality trends started to resume. It was a trifecta of formidable market forces converging all at once.

Today, while consumers are understandably concerned about the economy for multiple reasons, reliable data shows:

Home builders are pulling back on building, allowing historic housing shortages to persist.

Baby boomers are deciding to age in place instead of downsizing to another location.

Many homeowners feel locked into a low interest rate and are choosing to stay put. $27 trillion in equity will keep them from having to sell at a loss.

All the while wage increases are expected to continue, enabling future buyers to purchase homes in the years ahead.

Given these factors (not to mention investors who continue to gobble up properties for rental income) the Denver metro area inventory is unlikely to "right-size" for a very long time, if ever.

We appear, for the moment at least, to be riding out an economic shockwave that is likely to be short-lived given the basic laws of supply and demand.

Yes, it's an intense an anxious time for everyone. It's completely understandable to want to sit on the sidelines to see how things shake out.

If you do, don't be surprised if (when) interest rates dip again, possibly as early as next spring, pent-up demand quickly returns, and our all-too-familiar Seller's Market heats right back up ... bringing back multiple offers and all the headaches and heartaches that come with them.

Three important things to think about — no matter if you choose buy this year, next, or later:

Paying rent has the economic effect of a 100% interest rate to YOU, each and every month, each and every year.

As a homeowner, you can always refinance whenever rates go down.

If you really do want to own a home one day, ask yourself,"If not now, WHEN?"

This window of opportunity is absolutely real — especially for first time homebuyers taking advantage of down-payment assistance programs and possibly even seller-paid interest rate buy-down concessions — but could be very narrow. Call me whenever you'd like to discuss and explore options. I'm here to help, always, and would love to hear from you.

Michelle Schwinghammer is a REALTOR®, Certified Negotiation Expert® and Certified Pricing Strategy Advisor® who helps people move forward in Colorado. She currently serves as the West District Director for the Denver Metro Association of REALTORS and is proud to serve as a leader on its Community Alliance Committee.

SCHWINGSTATE, 5440 Ward Road, Suite 110, Arvada, CO 80002

(303) 638-8711, michelle@schwingstate.com

@schwingstate on Facebook, Instagram and Twitter

© Copyright 2022, Schwingstate, LLC

All rights reserved

I HELP PEOPLE MOVE FORWARD.

Comments